Not known Facts About Guided Wealth Management

Not known Facts About Guided Wealth Management

Blog Article

The Ultimate Guide To Guided Wealth Management

Table of ContentsAll About Guided Wealth ManagementGetting The Guided Wealth Management To Work4 Easy Facts About Guided Wealth Management ExplainedIndicators on Guided Wealth Management You Should KnowThe 5-Second Trick For Guided Wealth Management

Be alert for feasible conflicts of rate of interest. The consultant will set up a possession allowance that fits both your risk resistance and threat ability. Property appropriation is merely a rubric to establish what percentage of your total financial profile will certainly be distributed throughout various property classes. A more risk-averse individual will certainly have a higher concentration of federal government bonds, deposit slips (CDs), and cash market holdings, while a person who is more comfy with danger might determine to handle more supplies, company bonds, and maybe even investment realty.

The ordinary base wage of a monetary consultant, according to Indeed as of June 2024. Any individual can work with a monetary expert at any type of age and at any type of phase of life.

Guided Wealth Management - The Facts

If you can not afford such aid, the Financial Planning Organization might be able to assist with for the public good volunteer help. Financial advisors benefit the customer, not the business that uses them. They must be receptive, happy to explain financial concepts, and maintain the client's benefit at heart. Otherwise, you must try to find a new advisor.

An advisor can recommend feasible renovations to your plan that could assist you achieve your objectives better. Ultimately, if you don't have the time or interest to manage your financial resources, that's one more good factor to employ a financial advisor. Those are some basic reasons you could need a consultant's professional assistance.

An excellent monetary expert shouldn't simply sell their solutions, yet offer you with the tools and resources to become economically smart and independent, so you can make enlightened choices on your own. You desire an expert that remains on top of the monetary scope and updates in any area and who can answer your financial concerns about a myriad of subjects.

What Does Guided Wealth Management Do?

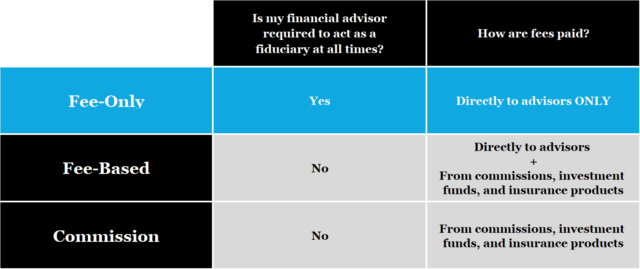

Others, such as licensed financial planners(CFPs), already stuck to this standard. Under the viability requirement, economic advisors typically function on compensation for the items they offer to clients.

Charges will certainly also differ by place and the advisor's experience. Some consultants may provide lower prices to assist clients who are simply beginning with financial planning and can not manage a high month-to-month rate. Usually, a financial advisor will certainly offer a complimentary, preliminary examination. This consultation offers an opportunity for both the client try this web-site and the consultant to see if they're an excellent fit for each various other - https://cziurd-bloiank-sleauh.yolasite.com/.

A fee-based consultant might gain a cost for establishing a monetary plan for you, while also earning a commission for marketing you a particular insurance policy item or financial investment. A fee-only monetary consultant makes no commissions.

Facts About Guided Wealth Management Uncovered

Robo-advisors do not require you to have much cash to begin, and they cost much less than human monetary advisors. Instances include Betterment and Wealthfront. These solutions can save you time and possibly money also. Nevertheless, a robo-advisor can not speak to you regarding the very best way to get out of debt or fund your youngster's education and learning.

A consultant can aid you find out your savings, exactly how to construct for retirement, aid with estate preparation, and others. If nonetheless you only need to review portfolio allocations, they can do that also (usually for a charge). Financial consultants can be paid in a variety of methods. Some will certainly be commission-based and will make a percent of the items they guide you into.

The smart Trick of Guided Wealth Management That Nobody is Discussing

Marital relationship, separation, remarriage or just relocating with a brand-new companion are all landmarks that can require cautious planning. Along with the commonly challenging psychological ups and downs of divorce, both partners will certainly have to deal with essential economic considerations. Will you have enough revenue to sustain your way of life? How will your financial investments and other properties be split? You may quite possibly need to change your monetary technique to maintain your goals on course, Lawrence states.

A sudden increase of cash money or assets increases prompt questions concerning what to do with it. "An economic consultant can aid you analyze the ways you might place that money to function towards your personal and economic objectives," Lawrence claims. You'll wish to think of just how much can most likely to paying down existing financial obligation and exactly how much you may think about spending to pursue a much more protected future.

Report this page